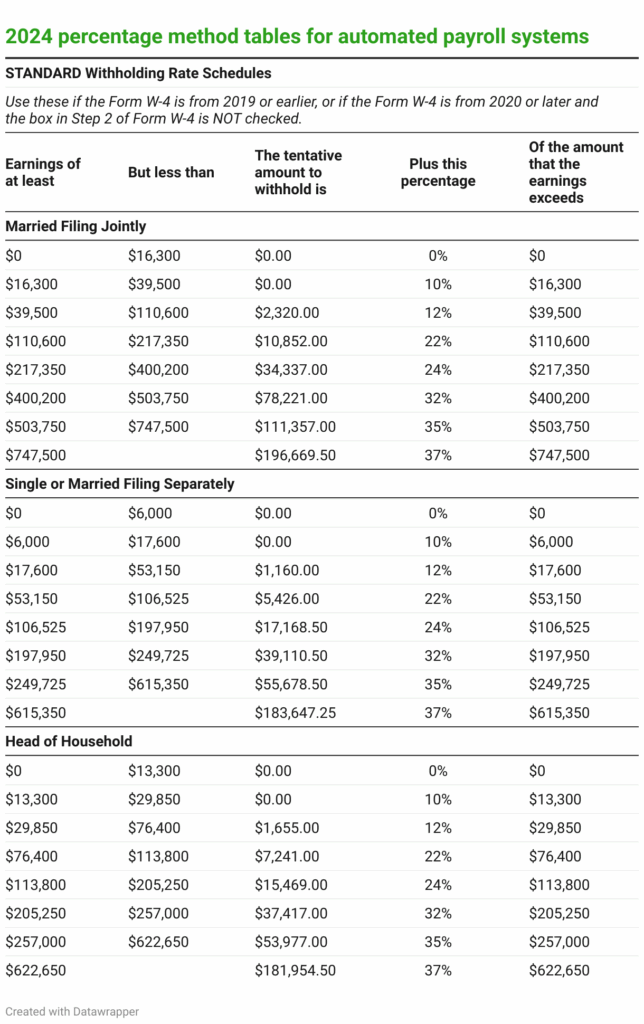

When it comes to withholding orders for garnishments, it’s essential to understand the concept of the Multiple Withholding Order Priority Chart. This chart helps determine the order in which multiple withholding orders should be fulfilled by an employer. Essentially, it outlines the priority in which different types of garnishments should be satisfied.

Multiple withholding orders can include various types of deductions, such as child support, tax levies, creditor garnishments, and more. Each type of withholding order is assigned a priority level based on federal and state laws. Understanding this chart is crucial for employers to ensure compliance with regulations and avoid potential legal issues.

Multiple Withholding Order Priority Chart

Factors Affecting Withholding Order Priority

Several factors can impact the priority of withholding orders on the Multiple Withholding Order Priority Chart. One key factor is the type of debt or obligation being garnished. For example, child support orders typically take precedence over other types of garnishments due to their importance in providing for the well-being of a child.

Another factor that can affect priority is the date of the withholding order. In general, older withholding orders may take precedence over newer ones, although there are exceptions based on specific laws and regulations.

Ensuring Compliance with Multiple Withholding Order Priority Chart

Employers must carefully review and follow the guidelines outlined in the Multiple Withholding Order Priority Chart to ensure compliance with federal and state laws. Failure to adhere to the correct order of priority could result in legal consequences, including fines and penalties.

It’s crucial for employers to have a solid understanding of the Multiple Withholding Order Priority Chart and to regularly review and update their payroll systems to ensure compliance. By prioritizing withholding orders correctly, employers can avoid potential legal issues and ensure that employee wages are properly distributed according to the law.

By following the guidelines outlined in the Multiple Withholding Order Priority Chart, employers can navigate the complex landscape of garnishments and ensure compliance with relevant laws and regulations.

Download Multiple Withholding Order Priority Chart

Fillable Online INCOME WITHHOLDING ORDER NOTICE FOR SUPPORT Fax

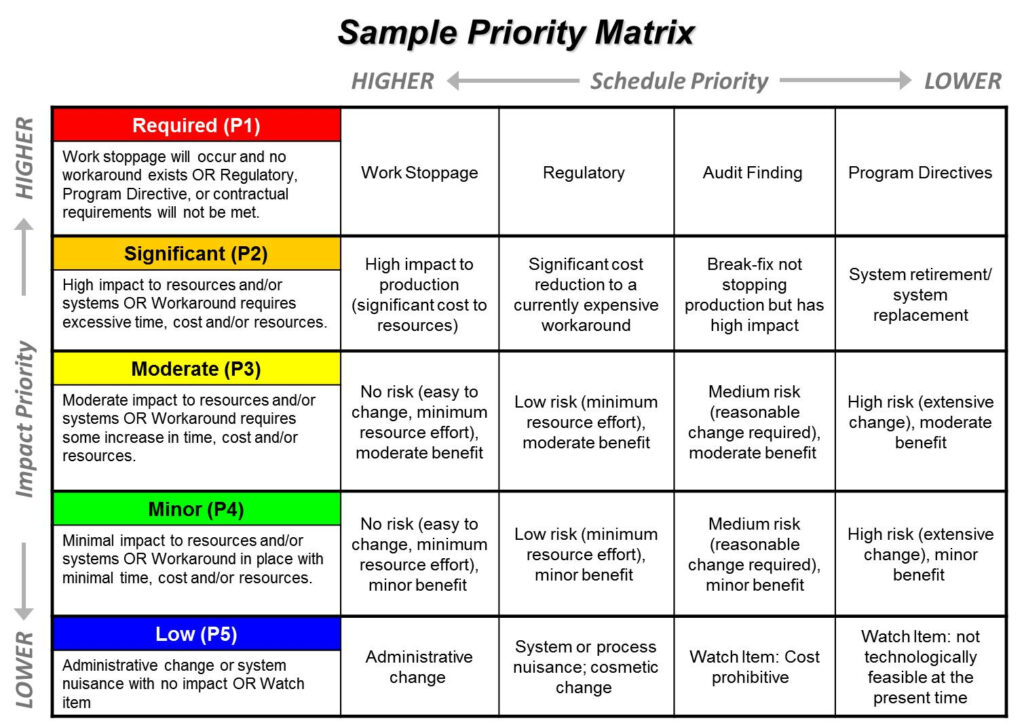

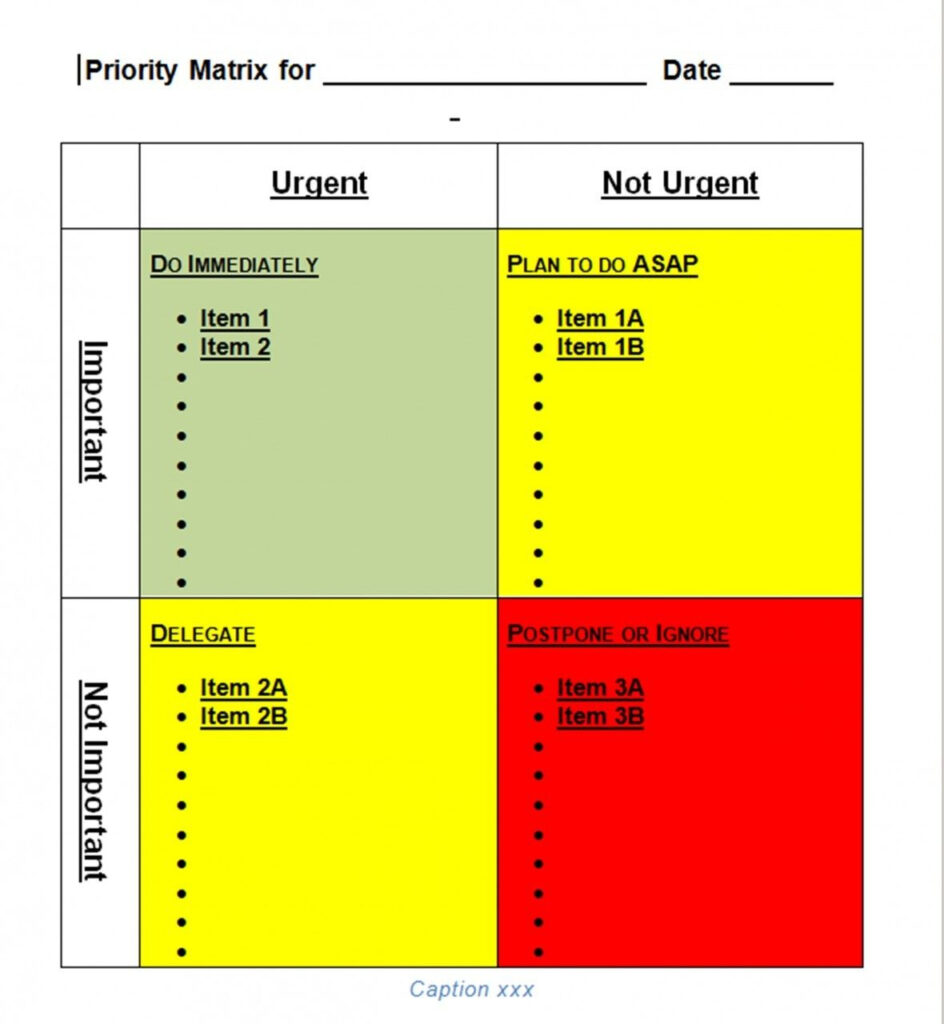

Priority Chart Template

Priority Chart Template

Withholding Order Templates PDF Download Fill And Print For Free