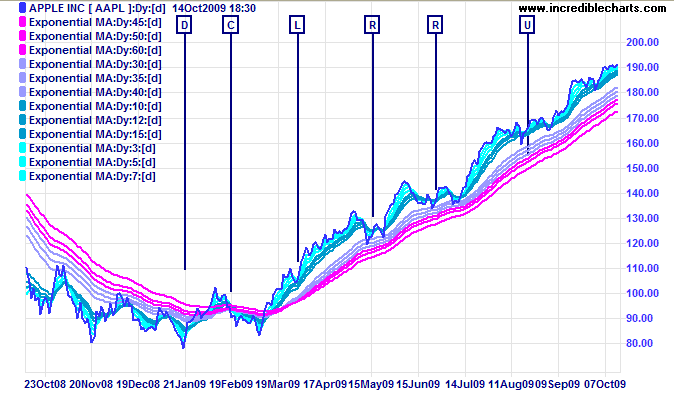

Multiple Moving Averages (MMAs) are a popular technical analysis tool used by traders and analysts to analyze and predict market trends. MMAs involve plotting several moving averages on a single chart to provide a clearer picture of price movements over time. By using multiple moving averages with different time periods, traders can gain a more comprehensive understanding of market trends and potential entry and exit points.

One common strategy with MMAs is to look for crossovers between different moving averages. For example, when a shorter-term moving average crosses above a longer-term moving average, it may indicate a bullish trend, while a crossover in the opposite direction could signal a bearish trend. Traders use these crossovers as signals to buy or sell assets, depending on their trading strategy.

Multiple Moving Averages Charts

Benefits of Using Multiple Moving Averages Charts

There are several benefits to using MMAs in technical analysis. First and foremost, MMAs provide a more comprehensive view of market trends compared to using a single moving average. By looking at multiple moving averages with different time periods, traders can filter out noise in the market and focus on long-term trends.

Additionally, MMAs can help traders identify potential support and resistance levels. When multiple moving averages converge at a certain price point, it may indicate a strong level of support or resistance. Traders can use this information to make more informed trading decisions and set appropriate stop-loss levels.

How to Use Multiple Moving Averages Charts

When using MMAs in technical analysis, it’s essential to consider the time periods of the moving averages you are using. Shorter-term moving averages are more sensitive to price fluctuations and can provide more timely signals, while longer-term moving averages are better suited for identifying long-term trends.

Traders should also pay attention to the relationship between different moving averages. Crossovers between moving averages can be used as signals to buy or sell assets, while the distance between moving averages can indicate the strength of a trend. By combining these signals with other technical indicators, traders can develop a more robust trading strategy using MMAs.

By incorporating Multiple Moving Averages Charts into your technical analysis toolkit, you can gain valuable insights into market trends and make more informed trading decisions. Whether you’re a seasoned trader or just starting, MMAs can help you navigate the complexities of the financial markets with confidence.

Download Multiple Moving Averages Charts

Trading Alchemy View Charts Moving Averages

Trading Alchemy Unleash The Power Of TradeStation

Multiple Moving Averages Bot Option Alpha Video Tutorial

Multiple Moving Averages MMA